Money & Matrimony: A Practical Guide to Joint Finances

how to contribute to and manage the family finances

Alright, lovebirds! You've found your lobster, your ride-or-die, the person who doesn't judge your questionable late-night snack choices. Congrats! But let's be real, beneath all the romance and shared dreams of that adorable little craftsman, there's a beast lurking: finances. Don't run away screaming! Whether you're fresh on the scene as a couple, trying to untangle a financial web that's not working, or just want to level up your money game as a duo, you've landed in the right place. We're about to break down how to manage your moolah as a team, no fluff, just the good stuff.

Spill the Tea: Getting Financially Naked (Yes, Really!)

Before we get down and dirty with bank accounts and budgets that don't make you want to hide under the covers, let's tackle the most crucial step: straight-up, no-holds-barred money conversations. Think of it as your financial truth serum – even if especially if you're not walking down the aisle just yet. It's about getting crystal clear on each other's financial baggage, current situation, and where you want your money to take you as a power couple.

Your "Money Origin Story": Seriously, have you ever thought about how your childhood influenced your money mindset? It sounds a bit woo-woo, but trust me on this. Were your parents savers or spenders? What are your knee-jerk reactions to a sale? Understanding these "money origin stories" can shine a light on why you might clash on certain spending habits.

Dream Big, Wallet Bigger (Together!): Forget just your personal goals for a sec. What epic stuff do you want to achieve as a unit? Buying that charming house with a white picket fence? Backpacking through Europe? Finally upgrading from takeout pizza to actual date nights? These shared dreams become your financial GPS, guiding your decisions as a team.

The Great Financial Unveiling: Okay, deep breath. Time to lay all your cards on the table – the credit card bills, the student loan statements, the whole shebang! Sharing your debts, income, and benefits can feel like stripping naked in front of each other, financially speaking. But it's a HUGE trust-building exercise and sets the stage for fairness. What's the game plan for tackling those debts? What are your income streams? Being upfront is the only way to navigate this financial landscape like pros.

Show Me the Money (and the Assets!): Don't just talk about the "ugh" stuff. What savings do you each have tucked away? Retirement accounts? Emergency funds for when life throws you a curveball (like that unexpected car repair)? How can you now support each other's savings goals? If you're saving for a down payment on that dream home with a garden, how will you combine your firepower?

No Financial Shade: Having these honest chats early, before any money-fueled arguments erupt, is pure gold. It means you can approach the topic with cool heads and zero resentment. Trust me, future you will thank you. Then, find a rhythm where you can continue to have these chats often (because money is always and forever changing in our lives).

The "Just in Case" Chat (Prenups, Anyone?): For those heading towards marriage with significant differences in assets or income, a prenup isn't unromantic – it's smart! It's about protecting yourselves while building a shared future. Think of it as a financial safety net.

Let's Talk Numbers: How to Split the Bills (Without Splitting Up!)

Alright, you've had the heart-to-hearts. Now for the juicy part: how do you actually divvy up the financial responsibilities? There are a couple of main ways couples tackle this, and we're going to break them down like your favorite morning coffee.

The Proportional Play: You Earn More, You Contribute More (It's Math!):

This approach is all about fairness based on income. If you're both bringing home roughly the same bacon, a 50/50 split on joint expenses might feel right. But what if one of you is raking in significantly more? That's where the proportional plan swoops in to save the day. Let's crunch some numbers:

Say Partner A nets $7,500 a month, and Partner B brings home $3,750. That means Partner A contributes 67% of the total income pie, and Partner B contributes 33%. Now, let's say your total monthly shared expenses and savings goals hit $8,000.

Here's the breakdown:

Partner A's share: 67% of $8,000 = $5,360

Partner B's share: 33% of $8,000 = $2,640

This leaves Partner A with $2,140 for their own fun money and savings, and Partner B with $1,110. It's all about contributing what feels fair based on what you bring to the table.

The All-In Fiesta: One Big Pot of Money Love:

This approach says, "What's mine is yours, baby!" You pool all your income into one big account and then use that to cover all your joint bills, savings goals, and shared adventures (hello, weekend getaways!).

Using the same income example, your total monthly income as a duo is $11,250. If your shared expenses and savings are $8,000, that leaves $3,250. How you divvy up that leftover cash for personal spending or extra savings is the next conversation. This method can create a strong sense of "we're in this together" financially.

Bank Account Shenanigans: How to Actually Organize Your Cash

So, you've figured out how you want to contribute. Now, let's talk about where that money actually goes. There's no magic formula here, just what feels right for you two. Banks like Ally Bank, for example, make it easy to open multiple checking and savings accounts, which can be super helpful for organizing your various money buckets.

Keepin' it Separate (But Making it Work):

Maybe you've both got your own established bank situations and want to keep things “business as usual”, especially if you’ve already been living together and tackling some joint financial responsibilities. You can totally keep your individual accounts, but you'll need a clear system for contributing to shared costs (as you were… regular transfers to cover rent) and now, those joint savings goals (a joint vacation account or future children fund).

Going Full "Our Money":

This often involves opening a joint checking account for all bills (personal and shared) and all spending (personal and shared), plus joint savings accounts for those big goals (that down payment on a house, anyone?). Do away with any individual accounts and just mash it all together. It creates a central hub for all things finances under your one marital roof.

Separate But Equitable:

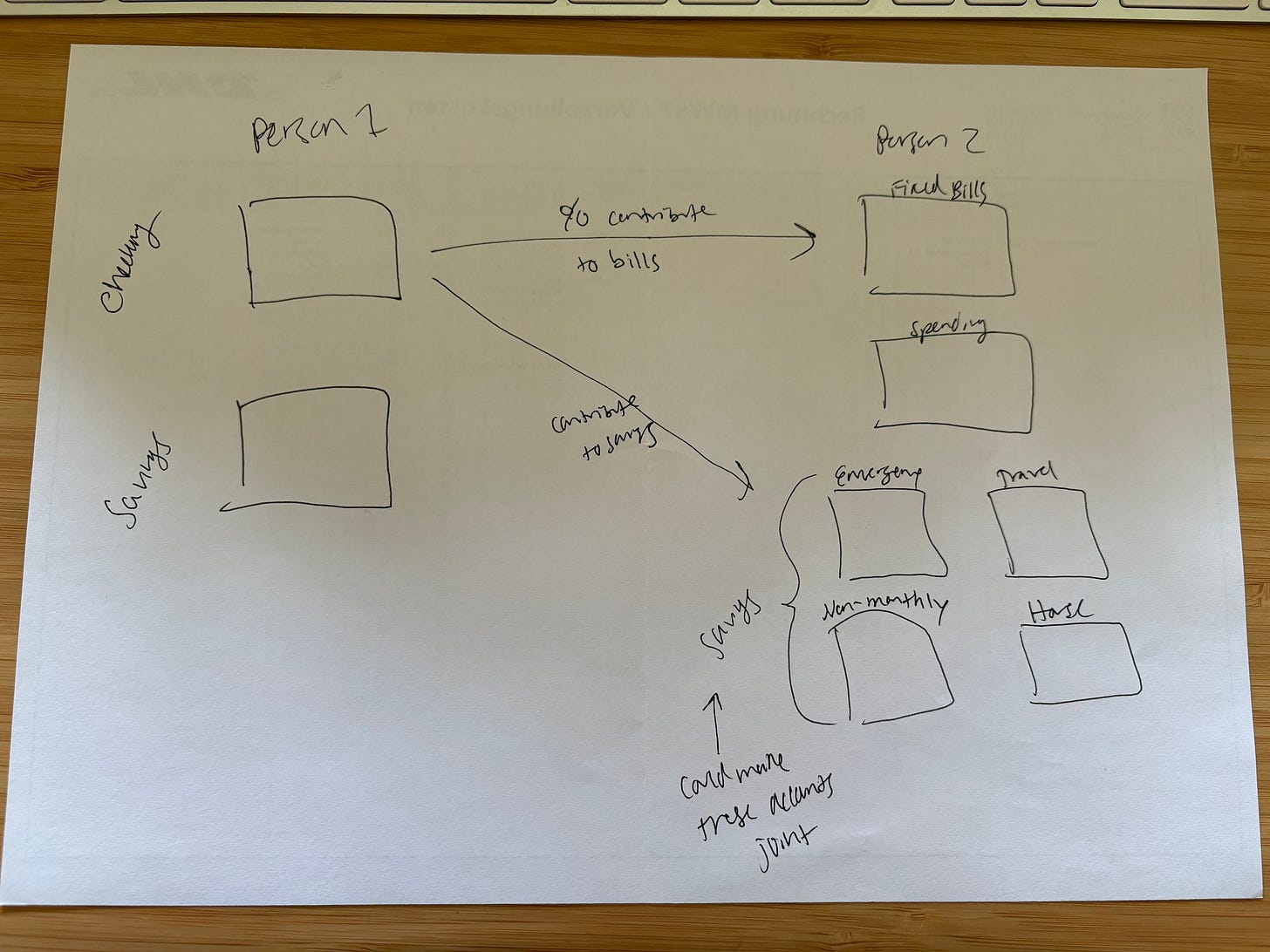

This can get a little more complex and often pairs well with the proportional plan. You keep your individual accounts but also set up a joint account specifically for shared expenses and savings, with each of you contributing your fair share. My signature budgeting method, which you can read more about here, would then have you contribute proportionally to family bills… what I call “Joint Fixed” and family/household spending items like groceries and date nights… what I call “Joint Spending”, plus a proportional contribution to your family’s emergency savings, non-monthly expenses and any other joint venture goal you’re pursuing together.

Meanwhile, the proportional part of your paycheck that you keep in your separate individual accounts allows you to pay for personal bills, cover personal spending that has nothing to do with your partner or household, and save for personal goals (even that means an individual emergency fund - I know, not romantic in the least, but so important for personal protection that you may never use ever!)

Team First, But Maintaining Individuality:

This is a sweet spot for many couples. It’s more streamlined than the above, but also works better with the “All-In” contribution plan. You have a joint account for shared bills, spending, and savings, but you also maintain individual accounts for personal splurges. Once all the family needs are covered by the paychecks being deposited into the joint family account, you can then determine the personal split that each partner gets to take to their individual accounts. Then, you might set up automatic transfers to these individual accounts each month or do it manually depending on the family’s needs that month.

The benefit of having your individual accounts is that you don’t have to worry about someone scrutinizing your every card swipe, tap and debit; however, I do think it’s important to keep the money transparency and communication going as financial infidelity is also a very real thing. My best tip: determine a dollar amount that feels “conversation-worthy” for your family. If you end up purchasing something for more than that amount, you have to first have a conversation about it. For example, my partner and I have our own "fun money" accounts. Our rule? Anything costing us over $300 gets a quick "heads up" because, at the end of the day, it impacts our collective financial picture.

The Fixed Flex Budgeting Lowdown (Your Secret Weapon!)

You might have heard whispers of "fixed flex budgeting" – it's my go-to method that I've been preaching for ages, and it's a game-changer for couples too! While I dive deep into this in this blog post and this loom video (pick your learning preference!), the basic idea is to know your non-negotiable expenses (rent/mortgage, insurance, debt payments) from your more flexible spending (groceries, entertainment, that impulse buy on Amazon). This approach plays nicely with any of the contribution and account setups we've talked about and gives you serious clarity and control.

The Bottom Line: You Got This!

Managing money as a couple isn't always rainbows and sunshine, but it's a crucial part of building a strong foundation. It takes open chats, a willingness to bend a little, and a system that makes both of you feel secure and heard. Whether you go proportional, all-in, or somewhere in between, the most important thing is to communicate and create a transparent, fair system. This is a living, breathing part of your relationship, so check in regularly, review your budget, and don't be afraid to make tweaks. By tackling your finances as a team, you're not just handling dollars and cents – you're building a brighter future, maybe even with that dream kitchen you've always wanted.

Your Turn!

What are your biggest head-scratchers when it comes to managing finances with your partner? Drop your questions in the comments! And don't forget, if you need assistance setting up your system and/or tackling all the other financial hurdles that earning a big income and navigating adult life throws your way, learn more about coaching with me and how you can hire me to be your own personal Chief Financial Officer.